“The big two are more-or-less head-to-head,” said IFR president Marina Bill, revealing the preliminary 2022 statistics at the Automatica exhibition in Germany this week, prior to the final figures being released in September.

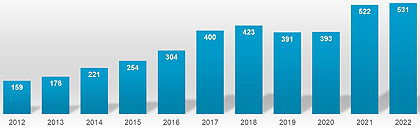

The IFR numbers show that after a 27% surge in global robot installations during 2021, take-up slowed to just 2% last year, taking the number of new installations to around 531,000. But the Federation predicts that growth could return to 12% this year. The number of robots sold worldwide has tripled over the past decade, despite Covid.

China remains by far the world’s largest market for industrial robots with 267,726 new machines being installed there last year (more than half of the global total), followed by Japan on 51,558, the US on 39,940, Korea on 30,336 and Germany on 26,344.

The metal and machinery sector is the world’s third-largest user of robots, with 64,446 machines installed last year (down from 66,086 in 2021), followed by plastics and chemical products on 25,437 (24,707 in 2021) and food on 13,237 (14,822 in 2021).

The number of industrial robots installed worldwide during 2022 grew slightly to hit an all-time high (figures in 1,000s)Source: IFR preliminary results

Drilling down into the figures reveals considerable differences by region, country and sector. For example, Germany is still the biggest user of robots in Europe but with only about one tenth of the number of installations in China. Italy saw a 10% surge in robot installations during 2022 (compared to 3% in Germany) but while the German market is dominated by the automotive sector with 7,127 new installations (down from 9,167 in 2021), in Italy it is the metals and machinery sector that leads the way with 3,670 installations, with the automotive sector in fourth place, behind plastics/chemicals and food.

The number of robot installation in France grew by 15% last year (to 7,449) with metals and machinery applications (1,645) being slightly ahead of automotive (1,597).

Bill says that there is considerable uncertainty over the future of the robot market in Europe but, with backlogs of orders in Germany and a tight labour market in many countries, the fundamentals for future growth are “very positive”.