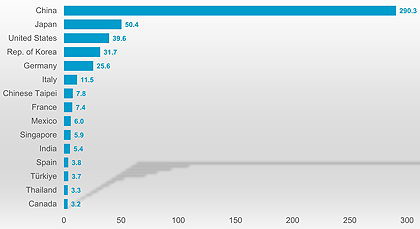

China is by far the world’s largest robot market. Its latest installations exceed those in 2021, which itself represented a 57% jump on 2020. On average, China’s robot installations have grown by 13% a year since 2017.

The number of working industrial robots in China rose from a million in 2021 to more than 1.5 million in 2022. Globally, there are now more than 3.9 million robots in use.

According to the IFR's latest World Robotics report, the European Union remains the world’s second-largest robot market with 70,781 machines sold in 2022 – a 5% increase. Germany accounts for 36% of all EU installations but the number of new robots it installed dropped by 1% to 25,636, compared to 2021. Italy has a 16% EU market share (up 8% to 11,475) while France accounted for 10% of the EU market (with 7,380 new robots representing a 13% rise).

Germany’s slight decline in robot installations can be blamed on a 27% drop in the number of new robots installed by the automotive sector (to 6,676) compared to 2021. Food applications also plummeted by 27% to 412 new installations, but metal and machinery applications rose by 19% to 4,187.

In the UK, industrial robot installations climbed by 3% to 2,534 units in 2022 – less than a tenth of Germany’s total sales.

In the Americas, installations were up 8% to 56,053 units in 2022. The US accounted for 71% of the installations in the region, with a 10% increase to 39,576, just below the peak of 40,373 units achieved in 2018. The main growth driver was the automotive industry where installations surged by 47% (14,472 robots). The automotive industry now accounts for 37% of the robot market in the US, followed by the metal and machinery industry (3,900) and electrical/electronics (3,732).

The world’s 15 biggest markets for industrial robots in 2022 (sales in 1,000 units)Source: IFR World Robotics 2023

Around the world, the biggest number of new robot installations during 2022 was in the electrical/electronics sector with 156,936 new machines, compared to 136,130 in the automotive sector. By far the biggest application was handling (accounting for around 266,000 new installations), followed by welding (87,000) and assembling (61,000).

Collaborative robots are continuing to penetrate the robots market, albeit from a small base. In 2022, the number of cobots ordered worldwide grew by 31% to reach around 55,000, thus accounting for almost 10% of the industrial robot market for the first time.

The IFR is predicting that the global market for industrial robots will buck the global economic slowdown and expand by 7% during 2023 to exceed a total of 590,000 machines, and will continue to grow at a similar rate in the period to 2026. Again, the growth will come mainly in the Asian market, with European sales expected to expand at a more modest 3% a year.

In terms of technologies, the IFR expects cloud computing and 5G mobile networks to result in new business models, and digitalised production. It predicts that wider use of machine vision will simplify programming and help to detect shapes and to guide grippers in complex environments. Meanwhile, AI (artificial intelligence) will result in faster programming, enhanced maintenance, and smarter, more efficient automation.