Innomotics brings together former Siemens activities in the areas of low- to high-voltage motors, geared motors, medium-voltage converters and motor spindles, as well as associated project and service offerings from Siemens Large Drives Applications (LDA) and Digital Industries businesses, as well as the separately managed Siemens-owned companies Sykatec and Weiss Spindeltechnologie. It employs around 15,000 globally and is currently being run as a separately managed Siemens subsidiary.

In a recent examination of potential suitors for Innomotics, Interact Analysis named ABB, WEG, Wolong, Danfoss and Nidec as possible buyers. It pointed out that Nidec, the world’s fourth-largest motor manufacturer, has a history of making acquisitions – it has made 73 acquisitions in its 50-year history, including Emerson Electric’s motors and drives business, which it bought for $1.2bn in 2016. If Nidec did buy Innomotics, it would probably be its largest acquisition to date.

Interact pointed out that Nidec currently has market share of less than 10% in the EMEA region, giving it a potential antitrust advantage if it seeks to make a purchase in the EU. The analysis added that acquiring Innomotics would give Nidec access to a similar motor range to its own, potentially facilitating integration of the two businesses.

Interact said that Nidec’s EMEA revenues would benefit “heavily” from such an acquisition, because Innomotics is the regional market-leader. This could deliver similar revenues to Nidec in the EMEA region similar to those of its Americas division.

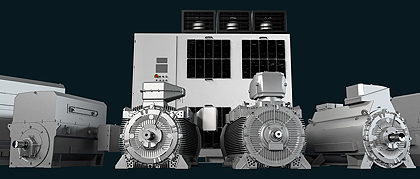

Attracting bidders: part of Innomotics product range

On the other hand, motors constitute just a fraction of Nidec’s total business, prompting the question of whether Nidec views the motor sector as a strategic priority for significant investment. Nidec’s motors business lost market share in 2022.