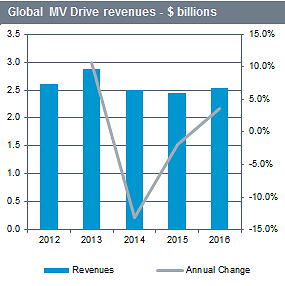

The downturn followed two years of double-digit growth in 2012 and 2013, which enticed several industrial automation suppliers without MV drive offerings (Danfoss, Regal Beloit, General Electric and Schneider) to acquire smaller MV drive suppliers, including Vacon, Benshaw, Converteam and LD Harvest.

IHS’ Medium-voltage Motor Drives Intelligence Service attributes the decline in MV drive sales to the drop in commodity prices during 2013 and oil prices in 2014. Investment in oil and gas, mining, metals and cement industries – which together represent more than 60% of MV drive revenues – slowed dramatically, leading to the decline in MV drive revenues in 2014 and a predicted further decline in 2015.

With more competitors in the MV drives market and reduced demand, price competition has increased, leading to price concessions of 5–10% in most regions, according to IHS. It predicts that MV drive revenues will contract again in 2015 and remain weak even into 2016.

Global MV drive revenues (blue bars, left-hand axis, $bn) and annual change (grey line, right-and axis, %) Source: IHS

From 2017 to 2019, however, IHS predicts that global demand for MV drives will rebound and that price concessions will end, leading to a more stable pricing environment.

The impact of the lower commodity prices has varied between industries. Those tied to the production of commodities have experienced more competition, declining MV drive prices, and falling revenues. But industries such as plastic and rubber have been benefitting from lower input costs, freeing up cash for them to buy MV drive equipment.