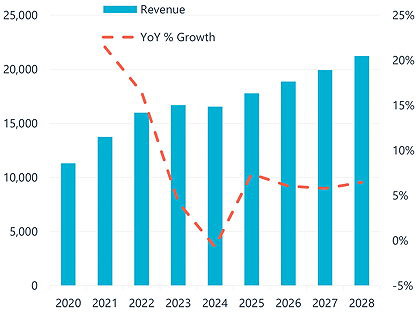

The 2023 slowdown followed two years of double-digit growth, fuelled by record price increases. Interact expects that 2024 will see a slight contraction of the market and increasing price competition, resulting in average sales prices worldwide falling to –2.4%. However, it predicts that growth will resume in 2025, and that by 2028 the market will return to historically normal levels of growth.

Some 65.3m LV AC motors were shipped last year – a rise of 2.9% on 2022. The Asia-Pacific (APAC) region reclaimed the top spot for growth, with revenues climbing by 6.4% in real terms, and unit shipments by around 4.5%.

ABB remains the biggest seller of LV AC motors. In 2023, it added Siemens’ Nema motor business to its portfolio, increasing its value by around $75m. Siemens, meanwhile, has split its large motors business off into a new company called Innomotics.

Interact thinks that the Japanese motor-maker Nidec expanded in 2023 after a lacklustre 2022, and predicts that the Chinese supplier Wolong will see its share grow as the Chinese market outpaces other regions into 2024.

Global LV AC motors revenues (blue bars, $m, left-hand axis) and year-on-year growth (dotted red line, %, right-hand axis) for the period 2020-2028Source: Interact Analysis

Having outperformed the EMEA and APAC regions in 2022, revenue growth in the Americas fell back to 4.3% in 2023, as economic uncertainty led to a “wait and see” mentality among many buyers. Revenue growth was flat in EMEA at 0.1% and it was the only region where unit shipments are thought to have fallen in 2023, as manufacturing nations such as France, Germany, Italy, and the UK continue to struggle.

“We are seeing increasing consolidation of the supplier base in the LV AC motor market, particularly in the US,” says Interact Analysis research manager, Blake Griffin. “For example, following an increase in its market share of 1.7% during 2021, WEG is expected to continue growing its stake further following its acquisition of Regal Rexnord’s industrial motors business in late 2023.”

Interact Analysis: Twitter LinkedIn