The findings come from a survey of more than 200 senior manufacturing executives conducted by the manufacturers’ group Make UK and PwC. The survey shows that after a difficult few years with Covid and soaring energy prices, there are signs of optimism, with companies being more bullish about the prospects for manufacturing in 2024. Most companies now see the opportunities as outweighing the risks to their business.

They are backing this belief by investing in new products, expanding into new markets and accelerating their use of digital technologies.

However, the survey also shows that manufacturers are wary of the prospects for both the UK and the global economies, while significant challenges remain in terms of high energy and employment costs, and limited access to skilled workers.

“The last few years have been a rollercoaster of emotions for manufacturers, yet they have more than demonstrated their resilience time after time,” says Make UK CEO, Stephen Phipson. “We are now seeing some hope that conditions may be improving, amid a more supportive and stable policy environment, but this must be cemented within a long term industrial strategy.

“While undoubted challenges remain, the accelerating use of digital technologies, our strength in innovation and expansion into new markets sets the scene for manufacturing to be at the heart of efforts to boost growth.”

According to the survey, more than half of UK manufacturers (52.7%) now see the UK as a more competitive place to operate. This compares with just under a third (31%) a year ago. Less than a fifth (16.6%) believe the UK is not a competitive place in which to manufacture.

Furthermore, almost a third of companies believe the UK is increasing its competitiveness against Germany and France (30.7% and 30.2% respectively) while more than a quarter believe the UK is moving ahead of Spain and Italy (29.3% and 28.3%). These figures are higher than those who see the UK’s competitiveness declining compared to EU rivals.

But the share of companies who believe the UK is losing competitiveness against the US, India and China dwarfs those who believe it is gaining.

The survey also reveals that manufacturers are bullish about prospects for the coming year, with more 44.4% believing that conditions in the sector will improve, while 20.5% expect conditions to deteriorate. Almost two thirds (62%) of companies see opportunities outweighing the risks this year.

However, 41.5% of companies expect the UK economy to deteriorate in 2024, compared to 36.6% who see it improving. A similar proportion (37.6%) see the global economy getting worse this year compared to 31.2% who expect an upturn.

More than half of manufacturers (52.7%) see opportunities in new products in the year ahead, while 27.3% are expanding into new markets and 26.3% are tapping net-zero opportunities. Furthermore, most see digital technologies as having the potential to boost productivity, with 71.2% believing that digitising their operations will boost their operational efficiency. In addition, more than half (52.2%) see generative AI raising the productivity of their workforce.

However, 53.2% of companies still see risks from higher energy costs, followed by the impact of political instability (43.9%). More than two thirds (36.1%) are still experiencing supply chain disruption, while 35.1% see the lack of access to domestic skills as a risk.

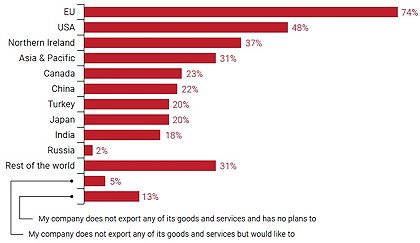

The EU remains the top choice for manufacturers exporting from the UKSource: Make UK TCA Survey 2023

"After what has been a rocky few years for manufacturers, it seems there is a cautious optimism in the air,” summarises PwC’s leader of manufacturing, Cara Haffey. “In fact, our research showed that in the year ahead, more than half of them are planning to seize opportunities in new products, with more than a quarter (27.3%) hoping to explore uncharted territory, and expand into new markets. For many, despite January's to-do list likely looming large, as the headwinds of sustained economic challenges, geopolitical instability, and steep employment and energy costs continue, the horizon seems brighter.”

The survey of 205 companies was carried out between 8 and 29 November.