This follows a period in 2021/2022 when high demand for consumer products boosted investment in automation.

According to Interact research analyst Alexander Jones, Siemens continues to dominate the motion controls market with its market share growing by almost 1% during 2022. The Chinese supplier Inovance is now the world’s fifth-largest motion controls vendor, boosting its market share by 0.6% during 2022. In 2018, the company was not even in the global top 10.

Although some motion control vendors are predicting market growth rates as high as 20%, others are more cautious, suggesting that 2023 will be a flat year compared to 2022, according to Interact’s survey of suppliers.

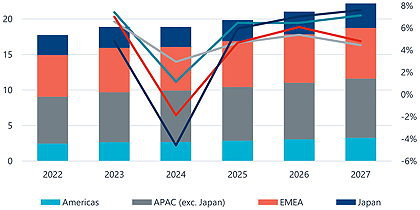

The Asia-Pacific region was the largest market for motion controls in 2022, accounting for 37% of global revenues, followed by EMEA on 33%, Japan on 16% and the Americas on 14%.

The global motion controls market by region showing revenues in $bn (bars, left-hand axis) and growth rates graphs, right-hand axis) Source: Interact Analysis

Japanese vendors saw a small decline in market share during 2022. But, after a sharp drop in growth, Interact predicts that Japan will have the strongest recovery of any region with an average growth rate of 6.9% in the period to 2027.

The analyst expects the Americas to experience the highest regional growth this year and to remain most resilient during 2024, with some of the largest buyers of motion controls – such as the semiconductor and electronics machinery sectors – performing well due to the uplift from the Chips and Science Act. The Americas region is expected to achieve the biggest growth rate in 2023 of 7.4%

Interact Analysis: Twitter LinkedIn