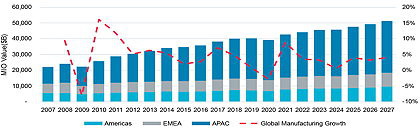

As a result of high oil and energy prices, strikes and the continuing conflict in Ukraine, Europe is the region likely to suffer most over the next few years, with a significant fall in total manufacturing output expected. “The landscape for European manufacturing looks bleak,” says Interact.

The worst-performing country in Europe is likely to be the UK. In 2022, UK manufacturing shrank by 4.3% and is likely to fall by a further 1.2% in 2023. Interact attributes this to a combination of trade union strikes, inflationary pressures and the high cost of living. Between 2022 and 2027, it expects the UK manufacturing sector to expand with a CAGR of 1.5% – the lowest of all European countries.

Germany is also in a weak position, with inflation currently running at 8.7%. In 2022, the German manufacturing sector is predicted to grow by 1.8% in 2023. Italy and France are also feeling the pressure of rising energy prices, high raw material costs and labour crises.

According to Interact, the Asia-Pacific region is performing particularly well and is “propping up” the rest of the world. In 2023, China's manufacturing output is likely to grow by 3.7%. Between 2023 and 2027 moderate growth is expected to continue, but the region will still suffer some of the effects of the expected global slowdown in 2024.

Global manufacturing growth 2007-2027, broken down by regionSource: Interact Analysis

The Americas region is doing relatively well due to a strong year in 2022. This year, manufacturing output is set to grow by $250bn. Interact reports that labour shortages continue to be a problem for US manufacturers, who are struggling to fill vacant positions.

“Despite all the negativity currently surrounding the global manufacturing industry, total output grew by 3.6% in 2022, with countries such as Denmark, Hungary and Argentina performing particularly well,” reports Interact Analysis CEO, Adrian Lloyd. “Overall, Europe also performed better than expected. The situation in APAC and China has also improved significantly since our previous updates as a result of Covid-19 restrictions being lifted, which has meant the manufacturing industry could get back on its feet.”

Interact Analysis: Twitter LinkedIn