IHS Markit and CIPS are linking the raised output to improvements in new orders, the speedy roll-out of the Coronavirus vaccine in the UK, and preparations for the planned loosening of lockdown restrictions. New business rose at its second-fastest pace for more than three years. Manufacturers reported improved demand from both domestic and overseas customers, rising business confidence and customers ordering early to protect themselves against potential price rises and further supply-chain disruption.

New export business rose at the quickest pace in the year-to-date, amid reports of improved demand from Europe, Asia and the US.

The rebound in domestic and global economic conditions underpinned increased optimism and job creation at UK factories. Business sentiment was at its highest for seven years for both consumer and investment goods producers. Almost two-thirds of UK manufacturers expect output to rise in the coming year (with only 6% predicting a contraction). Jobs growth was at a seven-year high, supported by the sharpest rise in backlogs of work for 11 years.

But supply-chain issues remain a “severe” issue for UK manufacturers, disrupting raw material deliveries, production schedules and the distribution of finished goods to customers. Vendor lead times were the second-longest extent in the survey’s history due to a combination of Covid-19 restrictions, low stocks at suppliers, port disruption, shipping delays, post-Brexit issues and raw material shortages.

With demand outstripping supply, input price inflation hit a 50-month high. This also led to upward pressure on output charges, which rose at the quickest pace since January 2017.

“Signs of spring have appeared in the UK manufacturing sector, with the PMI hitting its highest level in a decade,” comments IHS Markit director, Rob Dobson. “Growth of output, order books and employment all gathered momentum and optimism about the year ahead improved further. The domestic market remained the prime source of new orders, as companies reported that the vaccine roll-out and clients’ preparations for the loosening of lockdown restrictions underpinned the expansion. Many expect this process to be supportive during the year ahead as well, raising business optimism and jobs growth to their highest levels for seven years.

“Weak export sales and supply-chain issues are likely to remain constraints on growth moving forward, however,” he adds, “with shipping issues already leading to severe disruption to production schedules, raw material availability and the onward distribution of finished products to clients, especially abroad. The extent to which supply chains have worsened through much of the past year has been unsurpassed during the near three-decade survey history.

“Demand outstripping supply to such a wide extent is meanwhile driving up prices, with rates of inflation in input costs and selling prices both accelerating to near-record highs. The longer these inflationary and supply-chain worries persist, the greater the potential to curb the strength of the upturn as the economy unlocks in the coming weeks and months.”

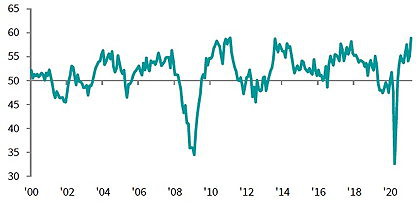

The UK manufacturing PMI has bounced back from a Covid-induced low last year. Any value over 50 is an improvement on the previous month.Source: IHS Markit / CIPS

According to Duncan Brock, group director at the survey’s joint organiser, the Chartered Institute of Procurement & Supply: “The floodgates to new business, rising confidence and more jobs were opened in March with the highest index level since the last recession and green shoots of recovery popped up across the UK as the global marketplace improved.

“Manufacturers picked up the pace to meet new orders rising at the fastest levels for three years with the domestic pipeline of work strengthening and previously deflated export orders bouncing back across the board, including from the EU,” he adds “In turn, suppliers were under the cosh to keep up as the list of shortages in raw materials increased leading to the second-greatest lengthening of delivery times in the history of the survey.

“However, these low points did not divert the sector from its enthusiasm about the coming year and with job creation, both were at a near seven-year highs. All in all, a great end to the first quarter where some businesses recovered losses from last year but the reality of continued supply chain disruption as a result of Covid, Brexit and now the Suez delays could potentially rein back some of the gains in April.”

Fhaheen Khan, senior economist at the manufacturers’ organisation Make UK, says that much of the progress in the sector “is due to an increase in domestic orders as businesses move through the gears due to expectations of a population eager to spend and increased confidence from the vaccine rollout.

“A strong domestic market only makes up half of the puzzle to the manufacturing sector’s success however,” she adds. “The other half lies abroad and the latest figures indicate export sales have also improved as businesses stockpile in an attempt to shield against price fluctuations, although shipping delays and doing business with the EU remains a concern.”

The survey data were collected from 12-26 March.

IHS Markit: Twitter LinkedIn Facebook

CIPS: Twitter LinkedIn Facebook