“This acquisition delivers on our strategic plan of investing in automation solutions and in markets where we have a global leadership position and see significant long-term growth opportunities,” says Emerson’s chairman and CEO, David Farr. “By adding Pentair’s Valves & Controls leading technologies and services to our already broad portfolio, we have positioned our businesses to grow, while continuing to provide our customers around the world with more complete solutions to their toughest challenges.”

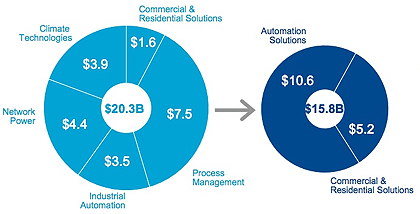

This acquisition follows Emerson’s recent sales of its Leroy-Somer, Control Techniques and Network Power businesses for a total of $5.2bn as part of a strategic repositioning programme that it started last year.

Pentair Valves & Controls, whose headquarters are in Switzerland, has nearly 7,500 employees around the world. Its brands include Anderson-Greenwood, Crosby, Vanessa, Keystone and Biffi. Its sales dropped 23% last year to $1.84bn as a result of the fall in oil prices, and Farr believes that they could drop further. But he expects the acquisition to raise Emerson’s share of the $105bn process automation market from 7% to 9–10%. In the $29bn final control market, the deal will boost Emerson’s share from 7% to around 13%.

The changing shape of Emerson: before its disposals of Leroy-Somer, Control Techniques and Network Power (left); and after its acquisition of Pentair Valves & Controls (figures in $bn)

“The Pentair Valves & Controls business is a strong fit for us as they share many of the same management principles that have defined success for Emerson over the years such as global customer support, service, best cost sourcing and manufacturing,” says Emerson executive vice-president and leader of its Automation Solutions business, Mike Train. “In addition to adding great people and brands to our business, it will allow us to expand our market position and create new opportunities for growth, while also being able to offer our customers the most complete valve solutions portfolio and most extensive service network in the world.”

UK-based Pentair acquired the valves and control business through its merger with Tyco International’s flow control business in 2012.