From 2011 to 2013, revenues from sales of LV AC and DC drives grew with a CAGR of a mere 0.3%. IHS attributes this to investment caution in Europe and to export demand from the Asia-Pacific region which has provided minimal incentives to invest.

Unit shipments increased faster over the same period, with a CAGR of 2.6%, as sales of lower-priced VSDs accelerated slightly. Although revenues did not expand much in 2013, early indications for 2014 suggest that investment sentiment has improved and IHS expects growth to accelerate in forthcoming years.

During the first quarter of 2014, growth in the global AC drives market dropped by 7.4%, but it was stronger than it had been in the first quarter of 2013, IHS says. And global revenues during the first quarter of 2014 were worth $2.47bn – more than 2% higher than in the first quarter of 2013, it adds.

“After several years of a repressed economic environment, Europe’s process markets will recover towards the end of 2014,” predicts IHS analyst, Kevin Schiller. “In addition, the upcoming Energy-related Products Directive (ErPD) deadline in 2015 will spur additional growth in the European variable-frequency drives market.”

As process markets improve in Europe, VSD sales growth will recover, leading, in turn, to a recovery in sales of premium drives. IHS expects economic activity to accelerate in all major countries, with the exception of Japan, in the period to 2016, with global growth reaching 2.9% in 2014 and 3.5% in 2015.

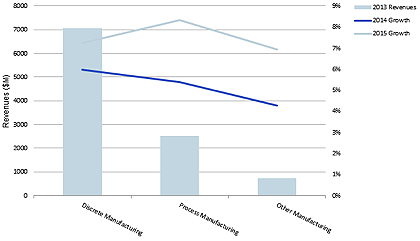

The analyst predicts that sales of VSDs for discrete manufacturing (their largest application market) will grow by around 6% in 2014 and by more than 7% in 2015. Sales to the discrete sector affect the market for compact and standard drives more than the premium drives market.

The global market for LV AC and DC drives, showing sector revenues (left-hand axis) and predicted revenue growth rates for 2014 and 2015 (right-hand axis)Source: IHS

While around 70% of compact and standard drive revenues come from machine-building, the discrete sector accounts for about half of premium drive revenues. The fact that compact and standard drives have lower average selling prices than premium drives helps to explain the recent differences in growth between revenues and unit shipments.

Since the 2009 global economic slowdown, machine-builders, distributors and system integrators have become more cautious about their machinery stock levels, IHS says. However, recent reports from suppliers suggest that sales to these customers are growing faster than those to the process markets.

Although revenues from the process sector have remained subdued, IHS expects sales to this market to grow by more than 5% in 2014 and more than 8% in 2015.

Because a stronger recovery in the EMEA region is not expected until later in 2014, this early growth has reinforced anecdotal evidence that the discrete markets are preparing for an increase in demand.