The seasonally adjusted manufacturing PMI for June – 57.3, up from 56.4 in May – was the highest since May 2010, signalling a strong improvement in business conditions. The average PMI for the second quarter of 2014 (56.4) was the strongest for four years.

Growth in output accelerated for the third month running, supported by a steep rise in new business – much sharper than in May, despite the growth in new export orders slipping to a five-month low.

Medium-sized manufacturers (with 100–499 employees) saw the strongest improvement in business conditions during June, while smaller firms (with fewer than 99 employees) recorded the least marked upturn.

“Business was booming at US goods producers in June,” reports Markit’s chief economist, Chris Williamson. “Factory output, order books and payroll numbers rose at some of the fastest rates we’ve seen since the recession, rounding off the best quarter for four years in terms of manufacturing expansion.

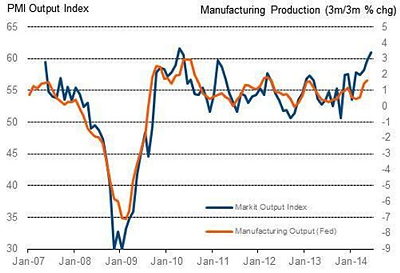

Markit and the Federal Reserve are both indicating a surge in US manufacturing outputSources: Markit; US Federal Reserve

“Manufacturing may account for only 13% of US GDP, but the sheer pace at which the sector is growing means it will have provided a major boost to the economy in the second quarter,” he adds. “Importantly, factory activity remains an important bellwether for the performance of the rest of the economy. We therefore expect GDP to rise at annualised rate in excess of 3%, more than reversing the contraction seen in the first quarter,

“Export performance, however, remains a real disappointment, and trade will likely act as a drag on the economy again in the second quarter,” Williamson warns. “If worries about tighter policy from the Fed start to dampen domestic demand at the same time as exporters are struggling, growth could slow again in the second half of the year.”