During June, Euro-zone manufacturing production expanded at its slowest pace since September 2013. The weaker trend was most evident in France, where output fell for the first time in five months. Slower production growth was recorded in Germany (a nine-month low), Italy and Ireland (both four-month lows), the Netherlands (an 11-month low) and Greece (a three-month low).

Underlying the slower expansion was a weaker increase in new orders.

By contrast, the Spanish PMI hit a seven-year high and Ireland reached a two-month high. Although the indices fell in all of the other Euro-zone nations, only France and Greece signalled outright contractions.

In Germany, output growth dropped to a nine-month low in June, with the weakest rise in new orders for almost a year. While output has been growing in Germany for 14 successive months, the June figure was the weakest since September last year. Employment in Germany was effectively static.

Markit economist Oliver Kolodseike suggests that the relatively strong Euro is acting as a drag on stronger export growth from Germany “and may continue to do so on coming months”.

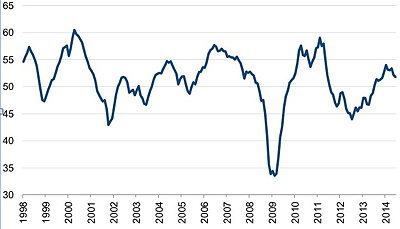

The Euro-Zone manufacturing PMI dipped slightly during June (50 = no change)Source: Markit

Across the Euro-zone, manufacturing employment rose for the sixth successive month in June, although the rate of growth was only marginal. France reported job cuts for the third month running, while a reduction was also registered in Greece. Spain reported its strongest increase in jobs since July 2007.

“With manufacturing growing at the slowest rate for seven months in June, the PMI survey will raise concerns that the Euro-zone recovery is losing momentum,” comments Markit’s chief economist, Chris Williamson. “There are encouraging signs of growth gathering momentum in the region’s periphery – especially in Spain and Ireland – and some of the slowdown in Germany may have been due to a high number of public holidays. But the overall picture is a reminder of just how fragile the region’s recovery is looking.

“Employment is barely rising in the manufacturing sector as companies worry about waning growth of new orders, which reflects very subdued demand for goods from households and businesses,” he adds. “The slowdown will put pressure on policymakers at the ECB to do more to prevent the recovery from stalling, and we will no doubt see more calls for full-scale quantitative easing to be implemented.”