The study says that drives sales in the region grew at double-digit rates in 2010 and 2011, but declined by 1% in 2012. It warns that growth ahead won’t be as expansive.

“The years of double-digit growth rates for Latin America are most likely a thing of the past,” says Rolando Campos, IHS’ motor drive and motion control research analyst. “As demand for commodities from China moderates and mining projects are delayed, drive sales will grow by about 7% annually through 2017. The path to higher growth rates, however, will not be a straight line and growth rates will vary widely by country.”

Because of lower commodity prices, many material extraction projects and expansions have been delayed. Commodity prices for rubber, pulp, chemicals, oil, non-ferrous metals declined by 15–40% in the year to March 2013. Precious metal prices – particularly gold – also have fallen.

In addition, environmental concerns have led to delays in some mining projects.

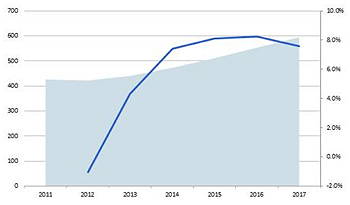

The Latin American market for LV AC and DC drives, showing revenues in light blue ($m, left axis) and CAGR in dark blue (%, right axis)

For example, the Minas Conga mining project in Peru has been delayed because local communities feared that their water source could be affected by the mining operations. Even so, some mining operators are finding ways to work with local communities by addressing their concerns before mining operations begin. Mining operators such as Mienra Yanacocha, for instance, are guaranteeing water supplies before commencing mining operations.

As commodity prices stabilise and environmental concerns are addressed, IHS predicts that Latin American LV motor-drive sales could accelerate from 2014 to 2017.

It adds that sales will vary by country, with growth in Argentina, Ecuador and Venezuela forecast to remain at less than 6% CAGR from 2012 to 2017. By comparison, sales in Peru, Chile and Brazil will achieve CAGRs in the range 7–13%, with demand coming from the water and wastewater, oil and gas, and food and beverage sectors, and from mining towards the end of the forecast period.