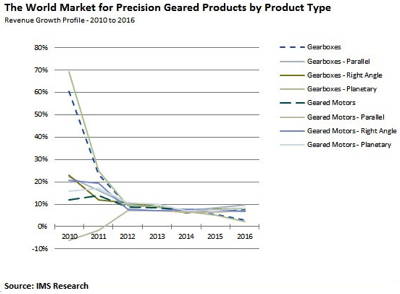

After a spectacular 80% spurt in global sales of precision geared products from 2009 to 2012, the market has braked sharply and the analyst IMS Research expects sales to contract by 1% during 2013. The main reasons for this are the uncertainty in the Eurozone and China’s decelerating growth.

Despite the contraction, IMS expects sales of precision geared products – gearboxes and geared motors with backlash ratings of less than 20 arc-minutes – to approach $1.7bn in 2013, with more than 1.8 million items being shipped. By 2016, it expects more than two million devices will be shipped.

Precision gearboxes represent more than 95% of the market and sales have grown by more than 70% since 2009, due to pent-up demand for servo-driven machinery and increased access to capital. Much of the demand has come from the automotive sector, where demand for industrial robots spurred a sharp rise in shipments of precision planetary gearboxes, which accounted for more than 82% of the precision geared products shipped in 2011. Automotive demand is now slackening.

“The future performance of the precision geared products market will depend greatly on what happens in 2013,” suggests IMS research analyst, Bryan Turnbough. “If current global economic conditions persist, then it could mean further deceleration in precision geared product shipments for several years because of the psychological impact that this slow recovery is having on industrial equipment end-users and OEMs. A bleak outlook makes it harder for them to invest in high-precision technology, despite cost savings that could occur over time.”

Sales to the robotics and machine tools industries, which accounted for about 39% of all precision geared products shipped in 2012, are forecast to grow by just 3.5% in 2013. According to Turnbough, it is possible that manufacturers of precision geared products could see shipments accelerate in the period to 2016 if the Eurozone economy strengthens and the US or China have a marked rise in growth.

He points out that Chinese industrial robot manufacturers “are still warming up to the idea of using high-precision geared products in robots”. They “tend to be more focused on the cost of the system than achieving the highest degree of precision. Japanese suppliers of industrial robots using precision geared products are finding it harder to compete as effectively with Chinese hydraulic industrial robot manufacturers in the region.”

IMS expects shipments of precision components to the materials-handling, woodworking and printing sectors, to grow at a slower pace in 2013, following the fulfilment of pent-up demand following the 2009 recession. Although shipments to the food, beverage and tobacco industries are expected to fall in 2013, growth could return from 2014 to 2016.